Program Related Investments (PRIs) offer a unique and powerful way for foundations to extend their charitable missions beyond traditional grantmaking. This innovative approach allows foundations to leverage their assets and generate sustainable impact. In this blog post, we’ll explore the concept of PRIs, their qualifications, benefits, challenges, and how to get started.

A PRI is an investment (e.g. loan, equity investment, or financial guaranty) made by a foundation to prioritize its charitable mission over investment earnings. The recipient can be a nonprofit organization or a for-profit enterprise.

How Does a PRI work?

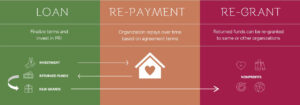

Unlike conventional grants, a PRI involves the foundation making an investment, typically in the form of a loan, equity investment, or financial guaranty, to a nonprofit organization or, in some cases, a for-profit entity with a social impact mission. The central tenet of a PRI is the prioritization of the foundation’s charitable mission over market-rate financial returns. When structured as a loan, the recipient entity is expected to repay the funds within a defined timeframe, possibly including interest. Upon repayment, the returned capital can be reinvested in additional charitable activities, effectively perpetuating the impact. In essence, a PRI allows foundations to leverage their financial resources to achieve philanthropic goals while preserving core assets for the long term.

How it Works

Qualifications for PRIs

1. Advance Foundation’s Charitable Objectives: PRIs must align with the foundation’s mission and charitable objectives. They should directly contribute to the charitable goals the foundation seeks to address.

2. Income Generation or Property Appreciation is NOT a Primary Goal: Unlike traditional investments, where maximizing returns is the primary objective, PRIs prioritize impact over financial gains. While returns are possible, they should be secondary to the charitable purpose.

3. Does Not Support Lobbying for Political Purposes: PRIs should not be used to support political lobbying activities. Their focus should remain on advancing charitable causes.

PRIs vs. Traditional Grantmaking

PRIs differ from traditional grantmaking in several ways:

- Funds Returned: Unlike grants, PRI funds are often returned, and in some cases, they may include interest. This return can be reinvested into other charitable activities.

- Funds Recycled: Repaid funds from PRIs can be re-granted to further support charitable missions, creating a revolving source of capital for impact.

- Complement Traditional Grants: PRIs can work alongside traditional grants, providing new capital to scale, kickstart, or sustain projects. They can also attract additional funders and bridge gaps in funding delays.

Benefits of a PRI

For Philanthropists:

- Multiply Impact of Charitable Funds: PRIs can amplify the impact of philanthropic dollars by re-purposing capital for multiple uses.

- Leverage Other Sources of Financing: PRI’s allow foundations to collaborate with other funders and leverage external financing, increasing the overall impact of their investments.

- Build Deeper Relationships with Nonprofits: PRIs foster deeper partnerships with nonprofit organizations, promoting more sustained and impactful collaborations.

For Private Foundations:

- Counts Toward 5% Payout: PRIs can count towards the mandatory 5% payout requirement, ensuring that foundations meet their charitable obligations.

- Helps Nonprofits Build Capacity: By providing financial support with the expectation of repayment, PRIs encourage nonprofits to strengthen their financial management and become more sustainable.

For Nonprofit Organizations:

- Bridge Funding Gaps: PRIs can help nonprofits bridge funding gaps and access additional capital to pursue their missions effectively.

- Increase Access to and Lower the Costs of Financing: PRIs provide access to affordable financing, reducing the burden of high-interest loans.

- Build Creditworthiness: Successful repayment of PRIs can enhance a nonprofit’s creditworthiness, making them more appealing to traditional lenders.

- Develop Longer-Term Relationships: PRIs encourage nonprofits to cultivate long-term relationships with foundations and philanthropists, fostering stability and sustained support.

How To Get Started

If you’re considering PRIs as a way to expand your philanthropic impact, here’s a simplified roadmap:

- Identify a PRI Opportunity: Look for opportunities that align with your foundation’s mission and have the potential for meaningful impact.

- Basic Financial Assessment of Organization: Conduct a financial assessment of the recipient organization to gauge their capacity to manage the PRI effectively.

- Negotiate Terms and Monitoring Plan: Collaborate with the recipient organization to establish clear terms, repayment schedules, and a monitoring plan.

- Draft Agreement for Organization to Review: Prepare a formal agreement outlining the PRI terms and conditions for the organization to review.

- Finalize Agreement: Once both parties agree, finalize the PRI agreement, ensuring that it aligns with your foundation’s mission and goals.

- Monitor PRI Progress: Continuously monitor the progress of the PRI to ensure it is effectively advancing your charitable objectives.

Program Related Investments offer a powerful tool for foundations to maximize their impact, create lasting change, and extend their philanthropic reach. By carefully navigating the qualifications, benefits, challenges, and steps to get started, foundations can use PRIs to forge deeper connections with nonprofits and drive greater impact than through traditional grantmaking alone.

OCCF can serve as valuable resources to support your PRI efforts. To learn more about PRI investments contact Cathleen Otero, Senior Vice President of Donor & Community Engagement.