Our goal is to invest assets for growth while protecting charitable capital for greatest impact over time. A balanced, diversified portfolio of stocks, bonds, mutual funds and alternative investments ensures that philanthropic capital is maximized through all market cycles.

Investment Performance

OCCF’s Investment & Financial Strategies

Investment Options

Money Market Pool

Designed to support short-term grantmaking goals and reflect donor preferences for investment risk. The money market fund includes investments in money market, commercial paper, corporate securities, U.S. Treasuries, etc. Annual investment fees are approximately 8 basis points.

Long-Term Investment Pool

Invested to provide safety through diversification in a portfolio of common stocks, bonds, mutual funds, alternative investments, and cash equivalents. Annual investment fees range from 85-95 basis points.

Sustainable Investment Pool

Invested in a portfolio of common stocks, bonds, mutual funds, private equity funds, and cash equivalents with Environmental, Social, and Governance criteria incorporated in decision making. Annual investment fees are approximately 76 basis points.

Prudent Investment Management

That’s been our strong suit since 1989. Assets are invested for both growth and capital preservation. Maximizing donors’ ability to make charitable impact in both the near and long-term is our primary objective. Investments are overseen by an experienced Investment Committee with the support of independent investment consultant Cambridge Associates, a leader in nonprofit portfolio management for over 40 years.

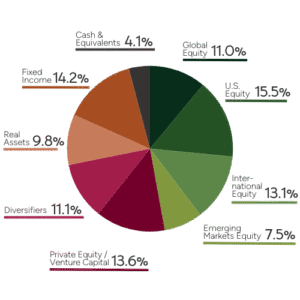

Asset Allocation

OCCF strategically manages investments to maximize returns and minimize risk. A balanced, diversified portfolio of stocks, bonds, mutual funds and alternative investments ensures that philanthropic capital is maximized through all market cycles.

Our Strategies

- Focus on the Long-term: Steady growth helps minimize risk to build lasting resources, rather than changing strategy based on short-term market conditions.

- Utilize Economies of Scale: Funds are combined for investment to leverage efficiencies. This allows smaller funds access to more sophisticated investment vehicles that might not otherwise be possible.

- Practice Portfolio Diversification: Diversification increases the likelihood of meeting or exceeding the fund’s desired return during market fluctuations.

- Track Fund Performance: Each fund is tracked individually. Comprehensive statements are issued on a quarterly basis, and all information is available anytime through the Donor Portal.